June 10, 2021

How price variation impacts employer health plan costs

Diane Faulkner

As the Contributor. Diane Faulkner is a ghostwriter, editor, writer, and brand strategist based in Jacksonville, Florida. She specializes in all things business, with emphases in human resources, finance, and tech. Diane writes for trade and business journals, creates corporate content, and has ghostwritten four books. See her work at dianefaulkner.com.

In-network price variation contributes to rising healthcare costs and wasteful spending. Here's what you can do to ensure your group health plans and employees get the best care at the best price.

Whether you’re shopping for a house, airline tickets, electronics, or groceries, price plays an important role in your decision-making process. But that’s not always the case in healthcare. When you need to get care, you often don’t know how much a doctor’s visit or procedure will cost in advance—and you certainly don’t know how those prices compare to those of another clinic or hospital in your network.

Because healthcare costs are opaque to both employers and consumers, price variation is widespread across carriers and geographies. Even within an individual plan in one geographic region, the cost of a standard healthcare service can be drastically different from provider to provider. Ultimately, this healthcare price variation contributes to rising costs for employer-sponsored health plans and their members.

Data shows widespread healthcare price variation

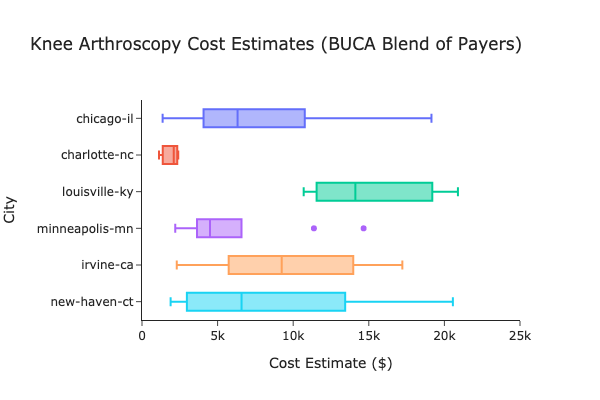

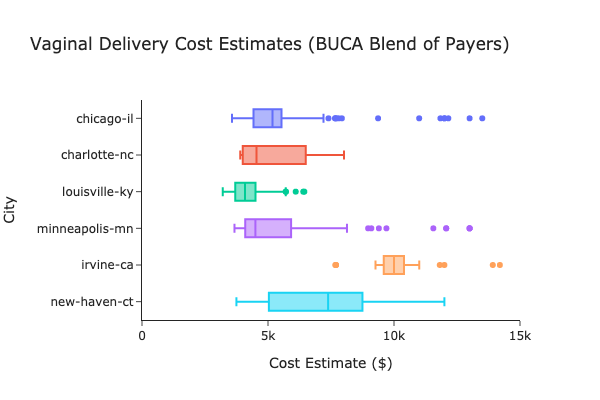

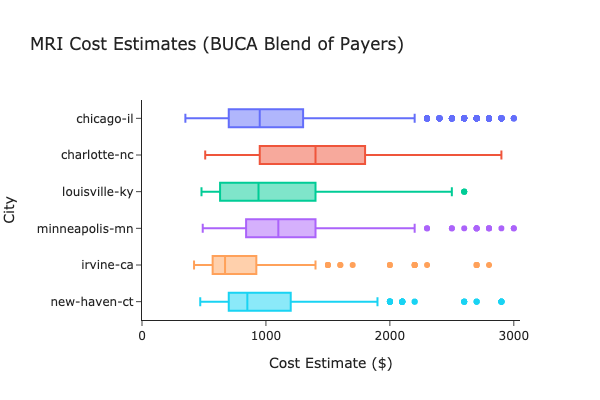

In April 2021, Amino analyzed claims data from the top four largest health insurance carriers—Blue Cross Blue Shield, UnitedHealthcare, Cigna, and Aetna (BUCA)—comparing costs for common services. Our analysis revealed wide variations in healthcare prices within networks in six geographic locations: Chicago, IL; Charlotte, NC; Louisville, KY; Minneapolis, MN; Irvine, CA; and New Haven, CT. These cities represent a range of regions and population sizes across the US.

The variations are eye-opening. In Charlotte, for example, the difference between the lowest-cost and highest-cost knee arthroscopy can be up to $1,200; in New Haven, the difference could be more than $11,000. The lowest-cost knee arthroscopy in Louisville is $10,201, whereas in Irvine—the next most expensive market—the lowest cost is $5,173. That’s a difference of more than $5,000.

Vaginal delivery costs also vary drastically across and within markets. For example, 75% of deliveries in Louisville are $4,500 or less, while in Irvine, 75% of deliveries cost $10,430 or less—a 131% difference. New Haven has the greatest in-market cost variation, with 25% of services costing $5,000 or less while 75% of services cost $8,724 or less. And although the majority of deliveries in Chicago are on the lower end of the range ($5,500 or less), it has several high-cost outliers, with some providers charging upwards of $14,000.

MRIs also showed cost variations across the six cities, with prices falling anywhere between $700 and $1,800—a wide range for such a highly standardized service. Charlotte had the largest variation of costs in-market, with lower-cost MRIs costing less than $950 and higher-cost MRIs clocking in at $1,800 or more.

This data shows that, even when you’ve picked a great set of health plans for your employees to choose from, there’s still ample room for price variation within those plans. And if you don’t have a way to educate your employees on how to shop for services, their out-of-pocket healthcare costs can unexpectedly soar—as well as your plan’s claims costs.

Why is there so much price variation in healthcare?

Because there’s no standardized pricing for healthcare services in the U.S., prices are closely tied to negotiating power. Major carriers that cover tens of thousands of members in a given region can negotiate lower rates with providers because they can commit to sending a high volume of patients their way.

On the other hand, if there are fewer doctors in a certain specialty or only one major hospital system in a particular area, providers can negotiate higher rates because carriers have no alternative options. To satisfy coverage requirements, carriers must have a certain number of providers as part of their network. In rural areas or geographies with lots of provider consolidation, a carrier may have to contract with every available provider to fulfill their service obligations—no matter what the provider chooses to charge.

Administrative costs can also figure into healthcare price variation. Billing and insurance-related services alone comprise about 15% of healthcare spending, and total administrative health plan costs make up around 30%. Providers may offset these costs by negotiating higher prices for healthcare services, unrelated to what other practices or facilities may charge.

Healthcare price variation made visible with new transparency regulations

Historically, neither employers nor their plan members have had easy access to healthcare price information. But that’s changing in the wake of a few recent transparency regulations. The Hospital Price Transparency Rule, which went into effect January 2021, requires hospitals to publish rates for 300 common “shoppable” (non-emergency) services. The Transparency in Coverage Rule, which goes into effect in January 2022, will make negotiated rate information available for anyone on a group health plan. And the No Surprises Act, passed as part of the Consolidated Appropriations Act in December 2020, will prohibit gag clauses in contracts that prevent employers from seeing full rate information for their plans.

The net result of these regulations is that healthcare price variation will no longer be hidden from view. Both employers and consumers will soon have access to fees for all in-network providers and be able to compare prices to determine who is more or less cost-efficient for specific procedures and services.

How can your benefits program mitigate the impact of healthcare price variation?

There are two primary ways to reduce the impact of price variation on your company’s healthcare costs.

The first is to invest in a healthcare navigation solution that steers your members away from low-quality, cost-inefficient providers. While price information is important, it’s not the only factor patients consider when making choices about their care. Look for a navigation tool that also provides information about:

- Provider clinical experience

- Quality of care (safety, appropriateness, and accessibility)

- Consumer healthcare experience

- What’s included in (and excluded from) the price of care

Showing employees how to weigh these factors alongside price can help them choose lower-cost care options without sacrificing quality or convenience.

The second option is to use contract prices to negotiate with your carrier (or provider group, if you have direct contracts in place). Your broker or consultant can help you analyze price data to identify variations and make the case for future rate adjustments or network changes.

With access to healthcare pricing data and tools to help you and your employees make sense of it, you’ll be able to identify price variations and take action to reduce spending on inappropriately expensive care.

Connect with our Partnership Team

Want to learn how we can help your members transform their healthcare experience in 2025?